Goods and Services Tax

The rollout of the Goods and Services Tax (GST) across India in 2017 marked one of the most transformative tax reforms. As Modi government enters its third term, it is a good time to deep dive into one of the most important laws introduced in its first term – Good and Services Tax.

History and Evolution of the GST

India’s pre-GST indirect tax regime was among the most complex in the world, with multiple tax and compliance requirements which would vary from state to state. The long journey of this much needed reform began when a single common GST to reform India’s indirect tax regime of GST was first proposed by Prime Minister Atal Bihari Vajpayee in 2000, and subsequently discussed in the report of the Kelkar Task Force on indirect taxes in 2003.

Since it impacted the revenue collections of both the Centre and the States, the passage of the GST Constitutional Amendment Bills required a two-third majority not only in both Houses of Parliament but also in the state assemblies. Though the Union Budget Speech of 2006 proposed to introduce a national level GST by 2010, the UPA Government failed to build consensus and address the concerns of the States Governments, leading to multiple delays in the rollout.

The impediments to the GST’s rollout continued till the Narendra Modi Government came to power in a landslide victory in 2014. The GST bill that was then introduced took on board the concerns of the States. The structure of the GST Council – the apex member committee formed to govern the laws and regulations – ensures that States have a greater voice in decision making, with a voting weightage of two-thirds against the Centre’s one-third.

Similarly, to address the concerns of revenue loss, compensation was paid to States for a transition period of 5 years, during which States’ revenue was protected at 14% per annum over the base year revenue of 2015-16.

As a consequence, the GST has been a boon for the finances of the State governments, as the GST contributes significantly to state revenues – States receive 100% of SGST collected in that state, approx. 50% of IGST (i.e. on inter-state trade). The RBI, in its Study of State Finances 2023-24 observed that “implementation of goods and services tax (GST) has led to increased tax buoyancy for the States.

A Pro-Poor and Pro-Business Reform

A comprehensive, multistage, destination-based tax regime, the GST replaced a highly fragmented indirect tax regime with multiple and cascading taxes. Previously, the Centre and States would each levy taxes on goods and services produced, resulting in end-consumers having to pay a number of taxes, including excise duty, sales tax, service tax, VAT, CST, purchase tax, entertainment tax, octroi and entry tax, etc.

Since each state charged a different rate of tax and had its own compliance requirements, the country was divided into multiple markets, leading to significant inefficiencies and costs of compliance. While the ‘tax ontax’ burdened consumers with cascading taxes, differences in state level compliance requirements and ‘nakas’ (check posts) at inter-state borders and at entrances to major cities for document verification and related processes added to the cost and complication of doing business.

The GST unified this fragmented tax system of 17 taxes and 13 cesses into a simplified 5-tier structure, and reduced compliance burden from 495 submissions across states to just 12.

In reducing the compliance burden and eliminating the need for tax ‘nakas’, the GST not only streamlined the movement of goods, it has also eliminated the associated opportunities that economists call ‘regulatory arbitrage and rent seeking’ – or in simple English, corruption.

Expanding tax base, improving compliance and reducing tax rates under the GST have resulted in a successive reduction in tax burden on consumers, even as revenues have steadily risen. A study by the RBI (2019) found that from a revenue neutral rate of over 15%, the effective tax rate reduced to 14.4% at the time of launch of the GST in 2017. The subsequent review and reduction of tax burden meant that the effective weighted average GST rate had fallen to 11.6% by September 2019.

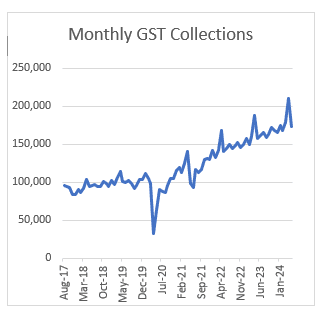

Simultaneously, GST revenue collections have gone from strength to strength, barring the brief period when the severe impact of the global pandemic. A recent analysis in New Indian Express shows how inflation – typically associated with positive growth– cannot alone explain the robust GST collections and instead attributes this growth to ‘improved compliance, plugging of loopholes used for evading taxes and improved economic activities’.

By S N Poojitha