A New GST rate comes into effect in India today.

Aplethora of food items, particularly pre-packaged items are expected to get costlier as the new Goods and Service Tax (GST) rates come into effect from today (Monday). Reportedly, after Union Finance Minister Nirmala Sitharaman chaired the 47th GST council meeting last month, it was unanimously decided to review the GST rates on different items. Have a look at what has become expensive and cheaper now:

What has become expensive?

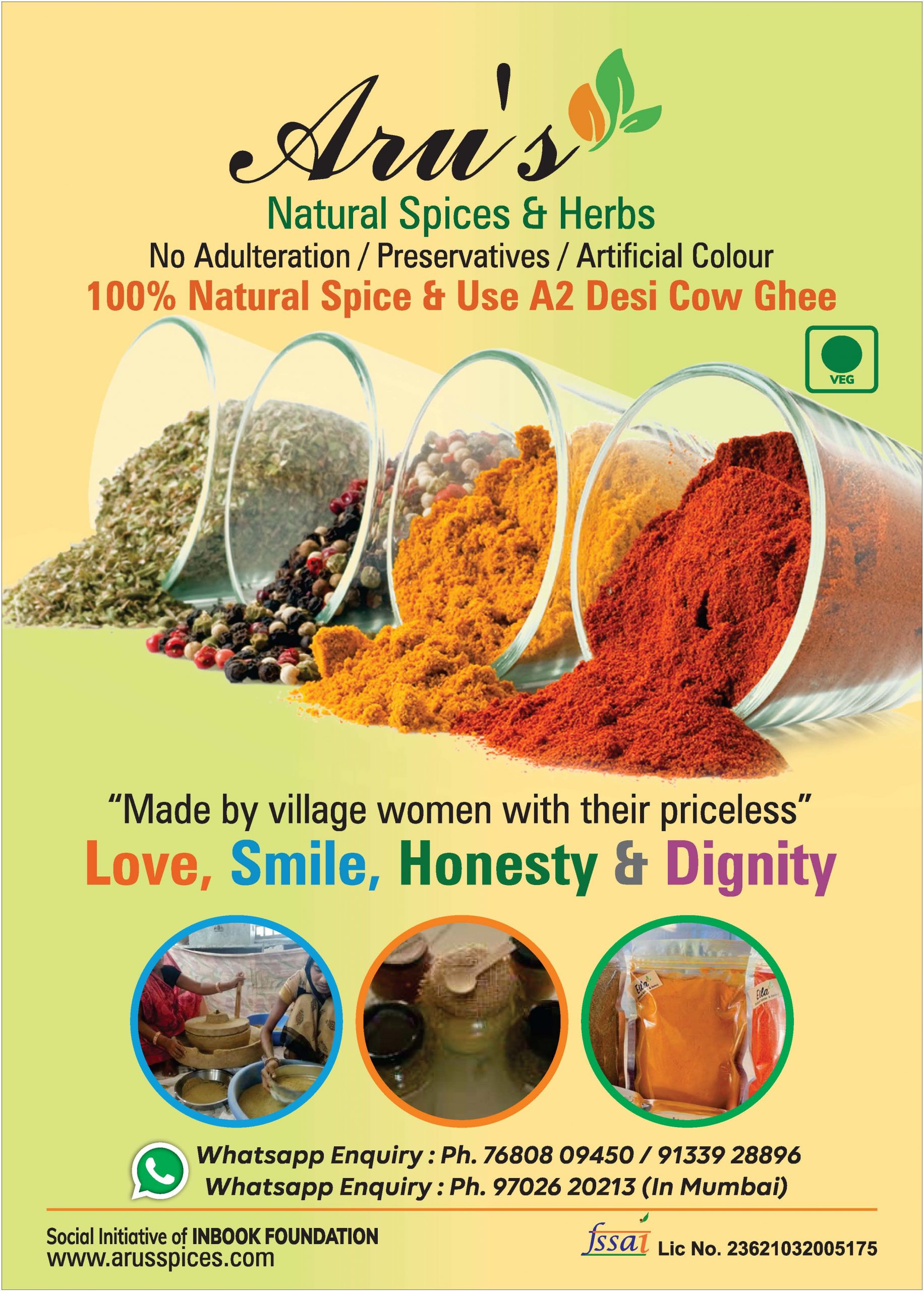

According to reports, pre-packed food items will invite five per cent GST. Curd, lassi, buttermilk. paneer (cottage cheese), honey, dried makhana, wheat, labelled meat and jaggery amongst other food-items is set to get expensive after the latest revision. Meanwhile, tetra packs will invite 18 per cent GST.

Central Board of Direct Taxes has also made cleared the definition of what constitutes a pre-packed food item. According to the directive issued, a pre-packaged commodity will be one that is packed, sealed or not-sealed in a package of whatever nature, in the absence of a customer. Essentially, a product that has a pre-determined quantity.

Stationery set to be expensive

Reportedly, your stationery is also expected to get expensive as printing, writing or drawing ink; knives with cutting blades, drawing and out marking out instruments, LED lamps will have 18 per cent GST slapped on them. A hike of six per cent from the last revision. Meanwhile, a 12 per cent GST will be imposed on maps and charts, including atlases.

Similarly, your bank stationery is also set to get a tad expensive as the council has levied 18 per cent GST, up 6 per cent from the prior arrangement, on the fee charged by banks for the issue of cheques.

Hotel rooms expensive

Those booking hotels earlier under Rs 1,000 per day will have to shell out more as the government has got rid of the tax exemption in the category and levied a 12 per cent GST on it.

What gets cheaper?

Your travel to the Northeastern states of India has become cheaper as the transport of passengers ‘to and from’ the region has been exempted from any GST.

Transport of goods and passengers via ropeway will get cheaper the GST council has slashed the rates of GST from 18 per cent to five per cent. Similarly, transportation by rail or a vessel of railway equipment and material has been exempted from any GST.

The application fee charged for entrance or for issuance of eligibility certificate for admission or issuance of migration certificate by universities is exempt from GST.

With an eye to increase the use of electric vehicles (EV) amongst the masses, the council has mandated that concessional GST of five per cent will be provided on EVs, whether or not fitted with a battery pack.

This news has not been edited by our staff and has been posted to keep the users updated about the things happening in and around the world.