Union Budget 2025-26: Income Tax Proposals and Their Impact on the Common Taxpayer

The Union Budget 2025-26 has introduced significant changes in the income tax regime, offering substantial relief to resident individuals while streamlining tax compliance procedures. These proposals aim to simplify tax calculations, reduce the tax burden on middle-income earners, and enhance transparency in tax administration. One of the most notable changes is the revision in tax slabs, ensuring greater savings for individuals with annual incomes up to ₹12 lakh. Additionally, the period for filing updated returns has been extended to four years, providing taxpayers with more flexibility in correcting past omissions.

Tax Slabs and Relief for Individuals

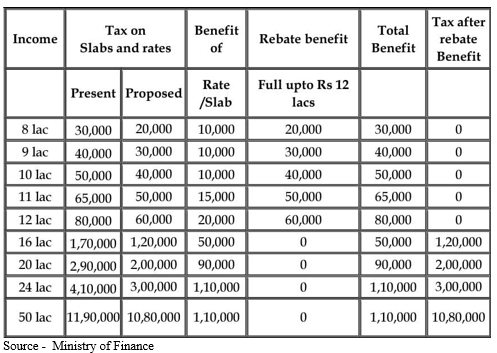

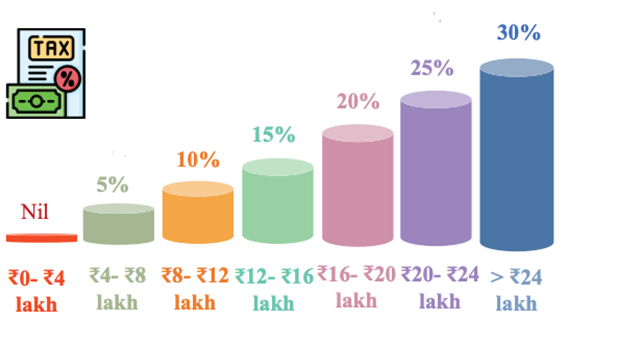

A major highlight of this budget is the revision of tax rates, which provides significant benefits to resident individuals. Under the new regime, taxpayers earning up to ₹12 lakh per annum can enjoy full rebate benefits, effectively reducing their tax liability to zero. For higher income groups, the new slab rates introduce lower tax burdens compared to the previous structure, ensuring that individuals across different income levels benefit from the revisions. Reduction in the tax paid will allow the public to have more disposal income which can be invested, thereby contributing to nation building. The reduction in taxes go hand in hand with the Prime Minister’s motive to include the middle class and common people in the nation building process through investments.

Marginal relief has also been introduced, ensuring that individuals who slightly exceed a tax slab do not suffer a disproportionately higher tax burden. However, taxpayers earning through special-rate sources—such as capital gains or lottery winnings—will not be eligible for the ₹12 lakh rebate benefit, ensuring that progressive taxation remains intact.

The below table can help in better understanding of the change in tax structure under the new regime –

The new Tax slabs are as follows:

TDS and TCS Revisions: Key Changes from April 1, 2025

From April 1, 2025, significant modifications in Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) rates will come into effect, impacting various transactions. The TDS threshold for commissions has been increased to ₹20,000, while the professional income threshold has been raised to ₹50,000, reducing the compliance burden for small-scale professionals. Rent payments will now attract TDS only if they exceed ₹50,000 per month, offering relief to numerous middle-class tenants. Additionally, the TDS exemption limit for interest and dividends has been increased to ₹10,000, making bank deposits and investments more tax-efficient for small investors.

Another significant move is the removal of TCS on the sale of goods, which will reduce the compliance burden on businesses. Additionally, the threshold for TCS on foreign remittances has been increased from ₹7 lakh to ₹10 lakh, easing the financial load on individuals sending money abroad for education or travel purposes. In a welcome relief to taxpayers, the provision that increased TDS rates for non-filers of income tax returns has been abolished, ensuring that taxpayers are not penalized solely for missing previous filings.

A summary of the changes in the TDS & TCS Regime are as follows:

- Commission Income: The exemption threshold has been increased from Rs 15,000 to Rs 20,000.

- Professional Services: The exemption limit has been raised from Rs 30,000 to Rs 50,000.

- Rental Income: The monthly exemption limit has been increased from Rs 40,000 to Rs 50,000.

- Interest Income: The TDS exemption has been raised from Rs 5,000 to Rs 10,000.

- Dividend Income: The exemption threshold is now Rs 10,000, up from Rs 5,000.

- Section 194J (Professional and Technical Fees): The limit has been increased from Rs 30,000 to Rs 50,000.

The following changes in TCS provisions have been announced:

- TCS on Sale of Goods Removed: The requirement to collect tax at source on the sale of goods has been abolished, effective April 1, 2025. This is expected to ease cash flow constraints for businesses and streamline trade operations.

- TCS on Foreign Remittances Relaxed: The exemption threshold for foreign remittances under the Liberalized Remittance Scheme (LRS) has been increased from Rs 7 lakh to Rs 10 lakh. This benefits individuals sending money abroad for education, travel, or other expenses.

Impact on the General Public

These reforms are expected to positively impact the salaried class, small business owners, and professionals by reducing tax outgo and increasing disposable income. The higher TDS thresholds for interest and dividend income will particularly benefit senior citizens and small investors, ensuring that they retain a larger portion of their returns. The abolition of increased TDS rates for non-filers is also a welcome step, as it eliminates the excessive tax burden on those who may have missed filing their returns in the past due to genuine reasons.

Which personal tax regime should you choose?

Choosing between the old and new tax regimes for FY26 depends on your income level, financial situation, and ability to claim deductions. The old tax regime allows various exemptions and deductions such as Section 80C (PPF, EPF, life insurance), Section 80D (medical insurance), House Rent Allowance (HRA), and home loan interest deductions, which can significantly lower taxable income. However, it comes with higher tax rates. On the other hand, the new tax regime offers lower tax rates but eliminates most deductions and exemptions. The Union Budget 2025 has made the new regime more attractive by increasing the tax rebate limit to ₹12 lakh, meaning individuals earning up to this amount pay zero tax. Additionally, the highest tax rate of 30% now applies to income above ₹24 lakh instead of ₹15 lakh earlier, making it more beneficial for higher-income taxpayers. In my opinion, the new tax regime is better as it allows for more disposable income and financial flexibility, giving individuals the freedom to choose investments without being forced to do so for tax-saving purposes. However, if you can take advantage of significant deductions such as Section 80C, 80D, HRA, and home loan interest (Section 24(b)), the old regime might still be a better option. That said, this is subjective and depends entirely on an individual’s tax planning and financial goals. It is always advisable to calculate tax liability under both regimes before making a decision.

Final Thoughts

The Union Budget 2025-26 has struck a balance between tax relief and compliance streamlining. By revising tax slabs, increasing exemption thresholds, and removing unnecessary levies, the government aims to ease the burden on taxpayers while ensuring better revenue collection. The introduction of marginal relief and the extended time frame for filing updated returns further demonstrates the government’s commitment to creating a fair and efficient tax system. While businesses and high-income individuals may still need to navigate certain complexities, the overall effect of these changes is expected to be highly beneficial for the general public.

By CA. Amit Bansal, Partner, Singhania & Co.

CA Amit Bansal, is a seasoned finance professional with 25+ years of expertise in financial advisory, tax consulting, and regulatory compliance.