PARTNERSHIPS: THE HIDDEN FACE OF SUBLEASING

By Anjali Jayan

INTRODUCTION

In the urban rental market, subletting has become a critical strategy for tenants to manage their rental costs. For tenants, subletting reduces rental costs and provides a source of income; for subtenants, it provides access that might otherwise be unaffordable. The introduction of various housing and hospitality platforms has amplified this trend. For many tenants, subletting via these platforms offers a lucrative opportunity to offset rental costs.

According to “Section 108(j) of the Transfer of Property Act gives lessee a right to sublease a property.” However, this right is not an absolute right and differs from contract to contract. If, in the absence of a sublease clause, a lessee leases out the property to a sublessee, then according to Section 108(j) of the Transfer of Property Act, the lessor does not have the right to evict the lessee on the grounds of subleasing. Usually, a lease agreement is bound to have a sublease clause, which the parties negotiate and come up with. Most lessors would not prefer the lessee subleasing a property and gaining profit from it. Therefore, an agreement usually includes a clause restricting the lessor from subleasing the property.

However, to defeat this provision, the lessee usually enters into a partnership deed with the sublessee. In the case of Helper Girdharbhai v. Saiyed Mohmad Mirasaheb Kadri and Others, the Court held that “in a case where a tenant becomes a partner of a partnership firm and allows the firm to carry on business in the demised premises while he himself retains legal possession thereof, the act does not amount to subletting.” In the case of Parvinder Singh v. Renu Gautam, the Supreme Court commented that “To defeat the provisions of law, a device is at times adopted by unscrupulous tenants and sub-tenants of bringing into existence a deed of partnership which gives the relationship of tenant and sub-tenant an outward appearance of the partnership while in effect what has come into existence is a sub-tenancy or parting with possession camouflaged under the cloak of partnership.” The partnership between tenants is constantly used as a defence for subletting in the real estate arena. Lessors who are already not favoured by the law suffer significantly from such an act, especially when the sublease clause was specifically mentioned in the contract. However, real trouble arises for the subtenants since tenants usually remain ex-parte and the burden of proving the existence of a partnership falls on the subtenant.

REAL DISPUTES IN ANDHERI AND MIRA ROAD

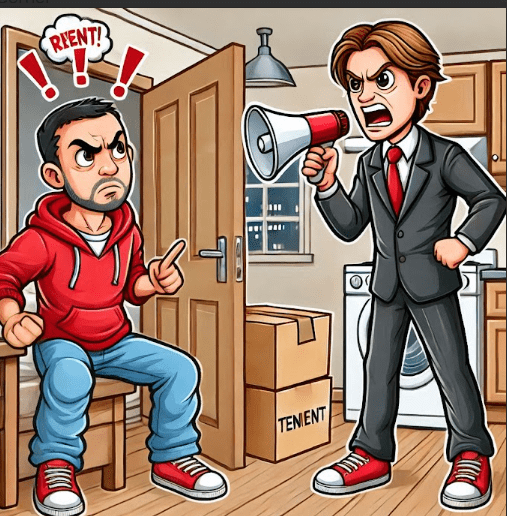

- Unauthorized Subletting in Mira Road

In a recent case in Mira Road, a tenant sublet a flat under the guise of forming a partnership with a family member. The landlord, discovering the unauthorized sublease, filed an eviction suit. The tenant claimed the arrangement was a legitimate business partnership. However, the court ruled that the tenant had relinquished control of the property, proving subletting despite the partnership claim.

- Redevelopment Conflict in Andheri

In Andheri, tenants faced eviction due to building redevelopment. A tenant argued they should receive housing post-redevelopment since they never legally sublet the property. The developer contended that a “business partnership” arrangement with a subtenant constituted illegal subleasing. The court ordered transit rent and directed that future housing be provided if the redevelopment proceeded, balancing tenant protections with property development needs.

UNDERSTANDING THE LEGAL BOUNDARIES OF SUBLETTING

The laws regarding subleasing and subletting are very ambiguous. Though Section 108(j) of the Transfer of Property Act allows a lessee to sublet a property, various judgements differ from the same. In the case of Gopal Saran v. Satyanarayana, the Court held that “sub-letting means transfer of an exclusive right to enjoy the property in favour of the third party”. This was elaborated more in the case of Shalimar Tar Products Ltd. V. H. C. Sharma, where it was held that to constitute a sub-letting, there must be a parting of legal possession, i.e., possession with the right to include and also the right to exclude others and whether in a particular case there was sub-letting was substantially a question of fact.

Since land-related matters fall under state jurisdiction, different states have varying rent control laws. Rent control statutes often favor tenants but also outline grounds for eviction. A partnership deed alone does not imply subletting if the tenant actively participates in the partnership business while retaining control over the premises.

However, when tenants relinquish control and use a partnership deed as a facade, courts scrutinize the facts carefully. Partnerships may also arise from tenants’ financial needs or family tax planning arrangements. If tenants attempt to conceal subletting through deceptive partnerships, lessors can introduce evidence to prove that tenants have parted with possession.

The legal complexities for subtenants are vast, especially when they are not considered necessary parties in eviction suits. Courts have underscored the need for detailed evidence but have yet to propose legislative amendments addressing partnership misuse in subletting.

CONCLUSION

Negotiating subletting terms between landlords and tenants is essential to avoid future disputes. Unauthorized subletting has become a significant legal challenge, often masked by fraudulent partnerships. Tenants exploit this loophole, creating legal complications for both landlords and subtenants.

Although judicial rulings have exposed such tactics, explicit legal provisions addressing partnership misuse remain absent. Legislators must strengthen statutes to curb such practices and protect all parties involved.

As the real estate market evolves, fostering transparent and legally binding rental agreements is crucial. Subletting offers flexibility and affordability, but only when governed by clear, enforceable terms. Ensuring transparency in lease agreements can minimize disputes and enhance trust